Diamond prices continued to decline in most areas last month, with the market split along category and geographical lines, Rapaport said. Goods under 1.20 carats were slow, while 2 carats and larger were steady. Fancy shapes outperformed rounds. Trading In India was quiet due to low overseas demand and the Diwali festival, in contrast to the US market’s steady activity.

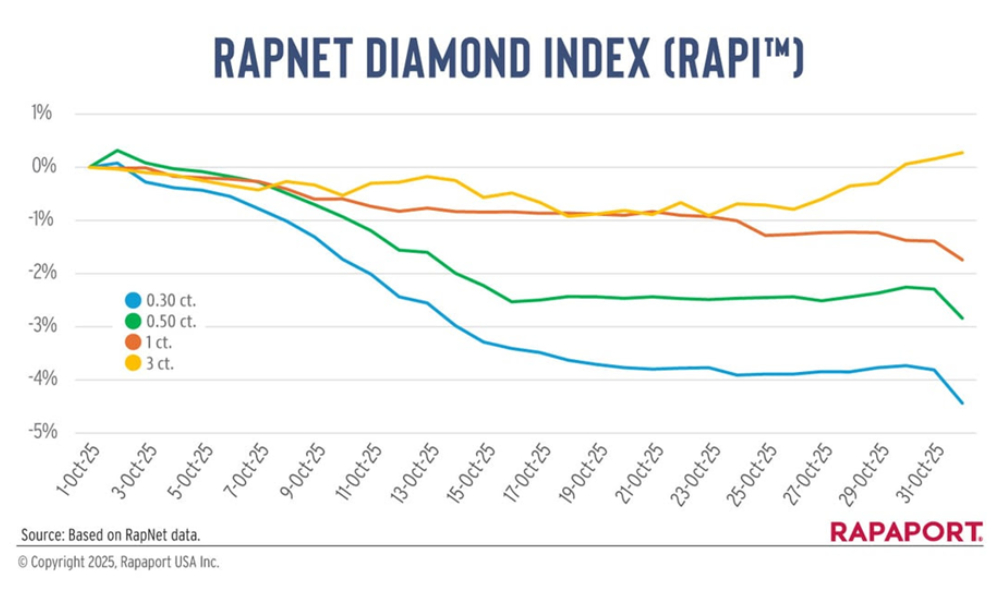

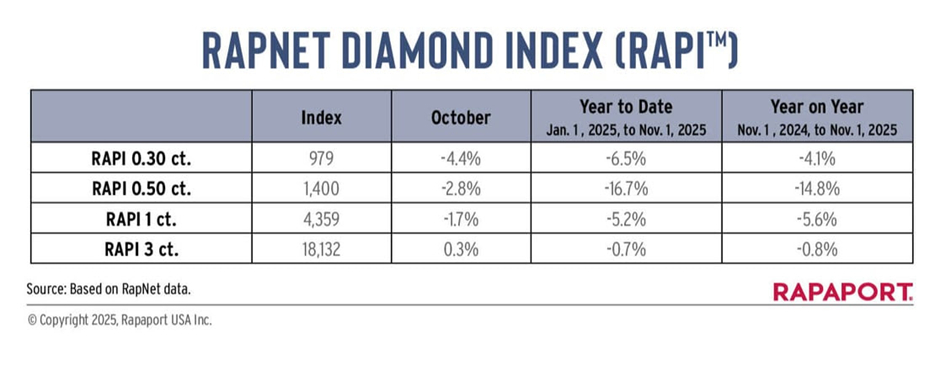

The RapNet Diamond Index (RAPI™) for 1-carat goods — which tracks round, D to H, IF to VS2 diamonds — dropped 1.7% in October. RAPI for 0.30 and 0.50 carats fell 4.4% and 2.8% respectively. The 3-carat index increased 0.3%.

SI diamonds were also weak. Prices for round, 1-carat, D to H diamonds in that clarity slid 3.2%, according to RapNet data.

While there was a slowdown in some fancy shapes after their recent strength, it was mostly in stones under 1 carat. Fancies over 1.70 carats remained robust, especially long shapes; marquises were particularly hot.

India’s manufacturing sector closed for Diwali, though production was already down because of slow demand. Factories reopened in early November to low sentiment as American tariffs continued to breed uncertainty. There was still no conclusion to trade talks between the US and India. The two were reportedly close to a deal pegging the duties at 15% to 16%.

Luxury was solid. LVMH reported strength at Tiffany & Co. in the third quarter. Kering noted sales growth at its jewellery brands, which include Boucheron and Qeelin.

The rough market was quiet amid the drop in manufacturing. De Beers kept prices steady at its October and November sights and allowed sightholders to refuse more goods than usual.

Anglo American’s efforts to sell De Beers heightened the uncertainty. Angola reportedly expressed interest in acquiring a majority stake, a change from its earlier plans to seek a minority holding. This pitted it against Botswana and other potential buyers, including former De Beers CEO Bruce Cleaver.

The combination of all these factors created a mixed outlook ahead of the holidays.