Alrosa’s annual report on the diamond investment market notes that the diamond market has fully recovered from the pandemic. A structural decline in production due to stock depletion and growing demand from end-users creates favourable conditions for sustained diamond price growth in the long term, especially for rare rough and polished diamonds.

Depleting stock and closures of mining assets have resulted in declining diamond production, leading to a rough diamond shortage, which is expected to persist, the miner said. This will support prices for rough and polished diamonds in the long term, particularly for investment-grade diamonds.

In 2020, diamond producers reduced their production by 20% from 2019 levels to 107 million carats. The natural decline amid the planned decommissioning of large, depleted deposits was exacerbated by Covid-19 and consequent lockdowns. A key milestone for the entire diamond industry was the closure of Australia’s Argyle mine in November 2020, which accounted for up to 10% of global diamond production.

Alrosa states that by following a ‘price over volume’ strategy during the crisis, diamond miners ensured the stability of the industry until demand normalised, creating the conditions for the price growth recovery. As a result, throughout 2020, polished diamond prices declined by about 3% year-on-year, and in the first nine months of 2021 they increased by more than 10%.

The Favourable Outlook For Diamond Prices

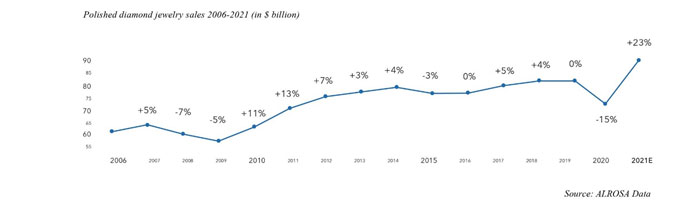

The beginning of the pandemic affected most sectors of the diamond industry. However, in the second half of 2020, retail jewellery sales began recovering rapidly, leading to an increase in demand and the prices of diamonds.

According to a survey by the National Diamond Council, diamond jewellery tops the list of the most attractive luxury goods as consumers remain loyal to natural diamond jewellery.

According to preliminary estimates, global diamond jewellery sales could exceed $90 billion in 2021, showing a 23% year-on-year increase.

In the two largest jewellery markets, the US (which accounts for 45% of global sales) and China (20% of global sales), demand for jewellery has risen by 50% and 10%, respectively, compared to pre-crisis 2019 levels.

At the same time, there is a growing interest in buying diamonds as an investment and financial hedging tool.

Diamonds As An Investment Asset

Investment grade diamonds have higher price growth expectations than diamonds in general. These are large colourless polished diamonds weighing 4 carats or more, and fancy coloured diamonds, which are declining in production at a faster rate.

The supply of coloured diamonds to the market is very limited.

According to the Gemological Institute of America (GIA), only one out of 10,000 carats of diamonds has a distinct, fancy colour. Due to limited supply, pink diamonds have seen a price increase of nearly 400% in the past 15 years. The closure of the Argyle mine, which accounted for 90% of the world’s pink diamond supply in 2020, sets the stage for further price increases for coloured diamonds and investment-grade diamonds in general.

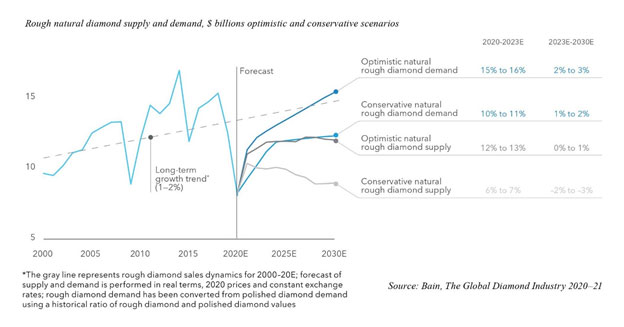

According to Bain’s outlook published in The Global Diamond Industry 2020-21 report, under any scenario of diamond supply and demand dynamics over the next 10 years, the deficit caused by the scarcity of the diamond supply will increase over time. Even if demand follows the conservative scenario while mining production grows along the optimistic one, demand will still exceed supply by the second half of the 2030s.

This means that the problem of the widening deficit will be resolved mainly by rising prices for rough and polished diamonds.

Thus, in an uncertain financial and political environment, high-quality investment-grade diamonds are becoming an increasingly attractive alternative asset. Their advantages include the price growth potential above inflation and the highest value concentration per unit weight. The absence of ownership registration requirements combined with the framework for reselling the diamonds created within the Alrosa Diamond Exclusive programme, make diamonds an attractive tool to preserve and transfer parts of the family wealth.