The Bonas Market Report for February-March 2020 points out that global retail has seen a very significant slowdown, which is likely to worsen following lockdowns in several parts of the world

The optimism that January heralded was short-lived as global retail has seen a very significant slowdown in the subsequent months. Covid-19 brought China to a standstill during one of its main selling seasons, and continues to keep stores shut.

Whilst the US has not been affected till the Bonas Market Report for February-March 2020 was drawn up, reordering has been lacklustre in the first couple of months despite a decent season. Europe is also feeling the effects due to the drop-off in Chinese tourists. And things have steadily gone south from there, as the threat from Covid-19 has only increased globally.

This has had an obvious impact on sales from the mid-stream. Polished prices have softened quickly and stocks are beginning to build again. Confidence has been severely shaken. Major miners had to take decisive action in 2019, and they are starting to do so again.

The hope is that the virus disappears as quickly as it arrived, and that the return to normality is swift. But at this stage, no one really can foresee how long the current situation will last.

BUSINESS CONFIDENCE DIPS IN INDIA

The current business slowdown has impacted the Indian diamond industry in many ways. There has been a serious net change in cashflow. Nobody had expected or prepared for such a strong brake to be applied to consumer demand in the Far East. This has directly impacted inventory levels and cashflow positions.

Cashflow from other investments has also dried up. Banks are again selectively tightening lending, which is creating further stress on companies.

Confidence has been severely shaken. Manufacturing has slowed and demand is depressed. No one knows when this will be over, and the concern is that we haven’t seen the worst yet.

Moreover, competition amongst manufacturers is so fierce that when there is an order for goods, the terms are not in their favour. Worries are also re-surfacing about who is financially strong enough to do business with. De Beers boxes that had been in demand for manufacturing in December and January are now being sold on the market at discounts, as there is little confidence to hold those goods. Most factories are reducing their manufacturing levels to match the reduced demand.

Even trading is very slow in India due to the loss of confidence because of the coronavirus, a depreciating rupee and pressure on polished prices.

There is some demand for USdriven retail and polished prices are holding in that area. Well-made fancy goods in 1.5ct+ are also performing well. But demand for Chinese goods has all but stopped. A few players have dropped their polished prices by 2-3% and are selling small businesses to those that can pay cash.

India is experiencing a huge slow down as liquidity dries up. Retail overall has decelerated. For Indian jewellers, gold prices have gone up but demand at these prices is reduced. As the rupee devalues, diamonds get 2-5% more expensive.

DEFICIENT DESIRE FOR ROUGH IN ANTWERP

As with other diamond centres, Antwerp is not immune to the virus outbreak. The mood on the market has worsened since January 2020, with many believing that the situation has deteriorated beyond that seen last year or even in 2008. It is likely that this could continue for another few months. As a result, the appetite for rough has slowed dramatically.

De Beers did not make any price changes. But it did offer flexibility by allowing people to defer boxes that predominantly produce goods for the Far East. This move was welcomed and applauded by many. However, there are other challenges, such as lack of flexibility in smaller sizes. As a result, some boxes got refused on top of the deferrals.

Whilst December and January were good months for Antwerp, that has now drastically changed. Many fear that significant quantities of polished will be coming off the wheels soon and will distort the market further. There are expectations that some large companies may yet again face liquidity issues, potentially resulting in distress sales.

Polished trading plunged in recent weeks. Business has dropped anywhere between 10-50%. No one knows how long the coronavirus crisis will last, how far it will spread and what impact it will have on consumer luxury spending. While many hope to see a V-shaped recovery at some point (soon), there is a general belief that the polished market won’t see a pick-up until second half of the year.

Feedback on sales is spotty; some buyers are still ordering as they have ongoing jewellery production lines, while others have slowed down or even stopped completely. Sourcing is price point focused and polished activity is concentrated on areas such as 1-2ct commercial goods and selective clean smalls. Several brands (especially those with high exposure to Chinese consumers) have indicated that they will be buying (much) less, going forward.

THE RETAILING LANDSCAPE

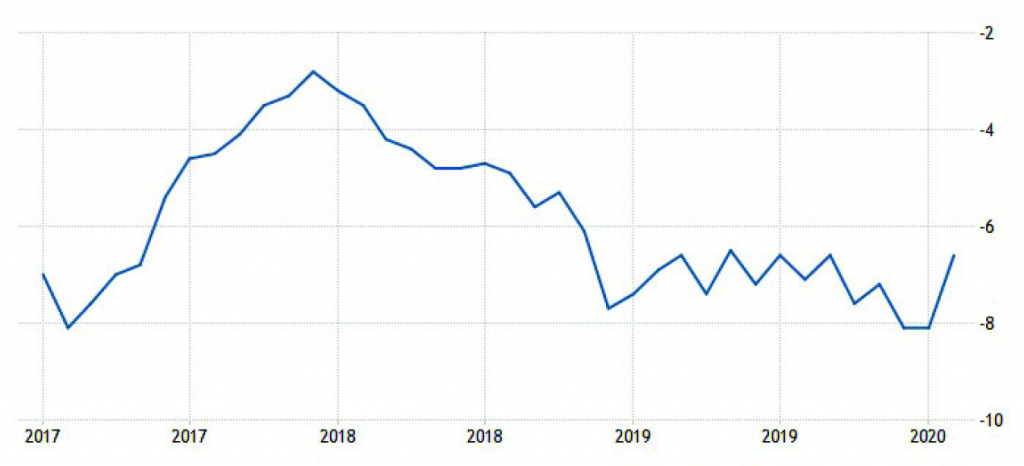

The consumer confidence indicator in the Euro area was confirmed at – 6.60 points in February, the highest reading since last September, thanks to households’ brighter expectations in respect of the general economic situation. It outstripped slightly more upbeat appraisals of their past and future financial situation, as well as their intentions to make major purchases. It seems that the threat of the coronavirus has not affected the European consumer confidence levels and/or has not fully kicked in yet, as per European Commission.

While the year started in a better mood, all European markets have now been seriously affected by concerns about the spreading Covid-19 virus. Italy, Europe’s biggest diamond market, has been described as ‘dead’. Last week two key fairs, Baselworld and Watches & Wonders Geneva (formerly Salon International de la Haute Horlogerie (SIHH)), decided to cancel their shows. As this is the main gathering for brands to collect orders from their retailer partners, it goes without saying that this will impact and complicate their sales and forecasts.

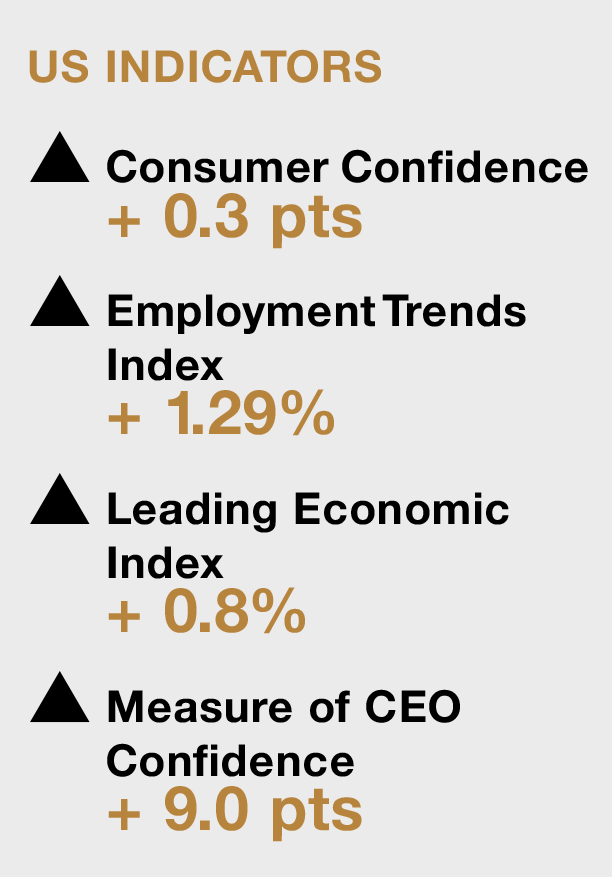

Coming to the US, the Conference Board Consumer Confidence Index improved slightly in February, following an increase in January. The Index now stands at 130.7, up from 130.4 in January. “Consumer confidence improved slightly in February, following an increase in January. Consumers’ assessment of current conditions was less favourable in February, however consumers were more optimistic about the shortterm outlook (combination of income, business and labour market conditions). This, coupled with solid employment growth, should be enough to continue to support spending and economic growth in the near term,” according to The Conference Board.

Watches of Switzerland Group announced that sales at Mayors for its third financial quarter, which includes the Christmas period, were up 9% on a like-for-like basis. However it is believed that most of this was driven by demand for watches.

Macy’s announced that comparable store sales for the fourth quarter were down 0.5%, but its destination business, which includes fine jewellery, rose 4.3%.

Most retail shops in Hong Kong are open but have no business, whereas stores in mainland China were closed and are gradually opening again, depending on the area in which they are located. Chow Tai Fook recently published an activity report for the first two months of the year that shows that on a same store sales basis, volumes were down 52% in mainland China and 61% in Hong Kong and Macao; down 50% and 57% respectively, in gem-set jewellery.

The report also stated that 70% of CTF’s POS in mainland China resumed operations and 64% in Hong Kong and Macao. The slow sell-through over that period means inventory levels with all retailers are higher than usual, and that will limit their appetite to buy new product.

A survey of 28 CEOs and CFOs-conducted by Altagamma, an association of Italian luxury companies, in conjunction with Boston Consulting Group and investment firm Bernsteinestimated the industry could lose €30bn to €40bn in sales this year, for an estimated total sale of €309bn in 2020. The consequence would be a roughly 15% drop in earnings for the industry, meaning a loss of about €10bn.

The main concern is business in China, where sales are plummeting due to widespread store closures and shoppers hunkering down in their homes. The survey estimates as many as 10 to 15 million products originally destined for China could go unsold, forcing companies to redirect those items to other parts of the world.

That said, many analysts believe economic activity will normalize from Q2 onwards, partly helped by the frontloading of monetary and fiscal stimulus, and a relaxation of regulation.

HOW COMPANIES PERFORMED IN ANTWERP

- Market premiums on De Beers boxes came down by a substantial margin, with many boxes trading below cost

- Alrosa did not make any noticeable changes to their pricing in February. Many believe they sold over $300m. The fact that Alrosa sold earlier in the month is likely to have helped them achieve this. Premiums also fell for Alrosa boxes

- Catoca did adjust to the market and reportedly goods were sold slightly cheaper than the month before

- Dominion sold a few goods on the Antwerp market. Prices were quite stable compared to last month

- Rio Tinto generally kept prices flat for both Diavik and Argyle, however some diamond companies believe that Argyle goods were actually slightly more expensive than last month

- Diavik volumes were about 20% lower and are expected to be 10-15% below last year’s levels for the rest of 2020. Argyle also sold small volumes

- ODC recently concluded its sale, which saw prices down substantially. With an average price anywhere between 7 to 10% lower, this gives a picture as to the situation on the market