Tough circumstances demand bold action. And the first budget of the new decade, Union Budget 2021, is a reflection of the Government’s forward-thinking approach to reviving the economy, especially after the unprecedented Covid-19 crisis.

The Union Budget 2021 has been universally praised for its trade-friendly stance. GJEPC, too, welcomed Finance Minister Nirmala Sitharaman’s visionary budget, which encompassed a reduction of Customs duty on raw materials like gold, silver and platinum to boost jewellery exports.

The Finance Minister has announced a slew of measures to boost gem and jewellery exports by cutting import duty on precious metals such as gold, silver and platinum.

Here are some highlights that will have a direct bearing on the industry’s growth performance.

- The import duty on gold and silver has been reduced from 12.5% to 7.5%

- Import duty on Platinum, Pallidum, etc. has been reduced from 12.5% to 10%

- Import duty on Silver Dore Bar is down from 11% to 6.1%

- The import duty on Gold/Silver Findings has been cut from 20% to 10%

- Import duty on Spent catalyst or ash containing precious metals is reduced from 11.85% to 9.2%

- Precious Metal Coins from 12.5% to 10%.

GJEPC Chairman Colin Shah, who raised a number of industry issues in a series of meetings with the Commerce and Finance Ministries, said, “We sincerely thank the Hon’ble Prime Minister and Finance Minister for this bold and pragmatic growth-oriented budget.

“The reduction in import duty from 12.5% to 7.5% will help the gem and jewellery exports become globally competitive. Reduction in duty on raw materials would give the much-needed boost to the sector and help it to move to the next level. In fact, high duty on precious metal had made our exports uncompetitive leading to large Indian diaspora/NRI, moving to Dubai, Hong Kong or other centres to buy jewellery, which was largely impacting the employment as well as business in India. Along with this, the halving of import duty on jewellery findings to 10% will help the jewellery exporters in a big way.

Budget 2021-22

| S.No | GJEPC Pre Budget Proposals | Budget 2021-22 |

| 1 | Reduction in import duty on Precious metals Gold/Silver/Platinum from 12% to 4% | Gold & Silver from 12.5% to 7.5%* |

| Gold Dore bar from 11.85% to 6.9%* | ||

| Silver Dore Bar from 11% to 6.1%* | ||

| Platinum & Palladium from 12.5% to 10% | ||

| Waste & Scrap of Precious metal from 12.5% to 10% | ||

| Spent Catalyst or ash containing precious metals from 11.85% to 9.2% | ||

| Precious metal coins from 12.5% to 10% | ||

| 2 | Intermediate products like Silver/ Gold Findings are being considered as finished jewellery for the purpose of levying duty when imported, must be considered as precious metal and levied with the duty applicable on import of precious metal | Reduced from 20% to 10% |

| 3 | Clarification on Online Equalisation Levy for B2B International Diamond Auctions | In order to provide certainty, it is being expressly clarified that transaction taxable under income tax are not liable for equalisation Levy |

| 4 | Increase in import duty on cut & polished [worked] Cubic Zirconia from 5% to 15% | Increased to 15% |

| 5 | Hike in Import Duty on Synthetic Cut & Polished Stones from 5% to 25% | Increased to 15% |

* Also, to attract Agriculture Infrastructure and development Cess at the rate of 2.5%

The reduction of import duty on silver dore Bar, gold/silver findings and spent catalyst or ash containing precious metals will make India the centre for refining these raw materials, thus generating more jobs in the sector. Also, considering the annual consumption of gold, India’s domestic and export market is going to benefit immensely.

The FM also announced the setting up of a new SEBI-regulated gold exchange. “We welcome the move as this will surely ease marketability and sale of gold,” he added.

Thanking the Prime Minister and Finance Minister for a visionary Budget, Vipul Shah, Vice Chairman, GJEPC, added, “The Finance Minister has done a remarkable job by presenting a bold, landmark Budget in these difficult times. It focused on investments in the infrastructure sector, consolidation of regulations, implementing digitisation in several sectors and reducing regulatory forbearance. There were also various measures to improve consumption.”

The slash to 7.5% import will make bullion and jewellery cheaper for the domestic consumer as well.

K. Srinivasan, Convener, Gold Panel, GJEPC, “This Budget is extremely good for the gems and jewellery industry. The reduction in import duty will help curb smuggling, thus spurring business in the organised sector. Overall, the Finance Minister scored a 100 out of 100!”

Hailing the reduction of import duty on silver in the Union Budget, Ram Babu Gupta, Convener, Silver Panel, GJEPC, noted, “It’s a very good move. The duty reduction will also help in unblocking some working capital,” he said, referring to tax collected at source for which refund is claimed from the IT Department after submission of accounts. “Duty reduction will also provide India a competitive edge in exports of silver jewellery.” Gupta was of the opinion that the duty cut would also balance out the price differential of the high cost of the metal.

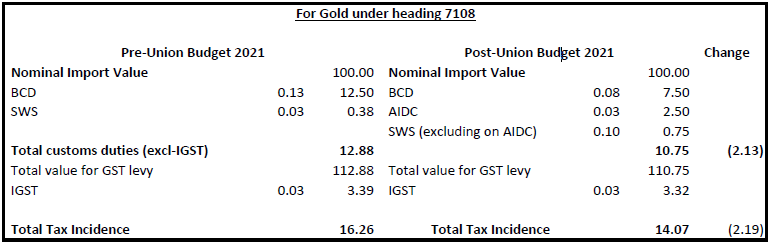

Somasundaram PR, Managing Director, India, World Gold Council, “The rationalisation of import duty on gold to around 10.75% from 12.5% is a welcome and timely move. Hopefully, this is the first of a series of such cuts to make bullion an asset class that operates mainstream. It is a much needed incentive for the organised and compliant players in the bullion and gold jewellery market. A rationalised duty structure and simplified processes are fundamental to an organised trading market. Following the appointment of the International Financial Services Centres Authority (IFSCA), to regulate the International Bullion Exchange at [Gujarat’s] GIFT City last year, the regulatory clarity in this budget around a domestic bullion exchange will spur infrastructure development and good delivery standards, enabling India to emerge as a major bullion trading hub.”

He added, “Revision of the procedure for disposal of seized gold to expedite the process will further prevent illicit trade. Rural welfare schemes announced by the Government to boost consumer sentiment will set the consumption cycles in motion and help the jewellery retailers as well. Overall, the budget should lead to positive outcomes for the industry.”

Sanjay Shah, Convener, Diamond Panel, GJEPC, said, “The duty drawback on import of gold, silver, and platinum has provided an impetus for the gems and jewellery industry to realise its potential and contribute to the country’s growth. Heartfelt thanks to the Finance Ministry for paying heed to the pleas of the industry.”

Rahul Mehta, Proprietor, Silver Emporium, was all praise for the reduction of duty on silver. “It was a much needed move for the industry, and will discourage smuggling. Domestically, this will boost sales of silver. Indians have a good appetite for gold and silver and now that the cost of acquisition for a buyer will go down by 2.5 or 3%, it will add more grams of gold or silver to his/her kitty. “The Council has done a fantastic job in convincing the Government with the right representation. I feel that the Government’s action is fair — reducing the duty by 5% (on paper), and that, too, during the pandemic, is a huge step! It also proves that the Government is viewing the industry in a positive light.”