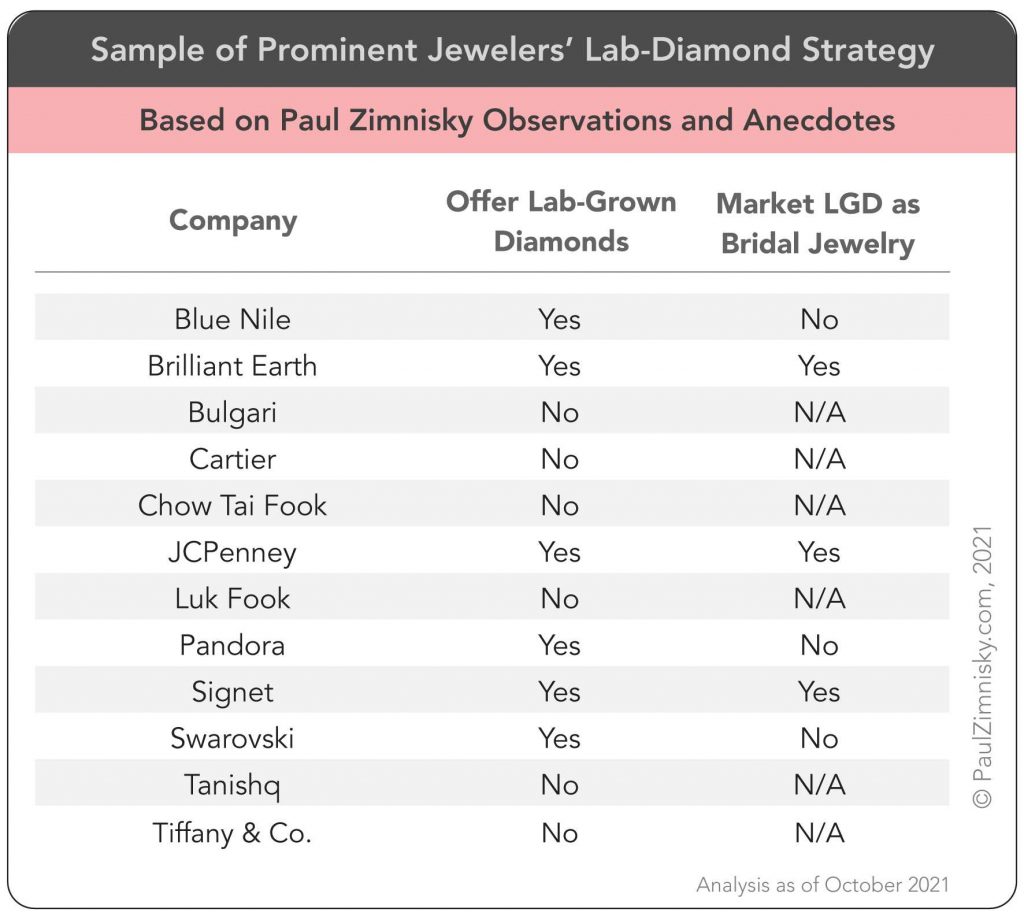

Diamond analyst Paul Zimnisky reports on the LGD jewellery marketing strategies of the renowned global jewellery brands.

During a four-hour-long analyst event in September, the largest fashion-jeweller in the world, Pandora, provided an update on its recent foray into lab-grown diamonds. The line, branded as “Pandora Brilliance” is currently being tested exclusively in the company’s UK market, however, management said that a global rollout decision “will probably come towards the end of the year” as the company is still “learning how to maneuver in the space.”

Pandora, which is known for its iconic charm bracelets, sells an estimated 100 million pieces of jewellery a year – with the average customer purchase estimated at around $75 for two items. Pandora Brilliance adds a new dynamic to the company’s merchandise mix with an initial price point that ranges from £250 ($340) for a 0.15-carat lab-diamond set in silver to £1,290 ($1,765) for a 1.0-carat stone set in gold.

With 6,700 point of sale in more than 100 countries, Pandora is likely the largest jewellery company in the world to enter the lab-diamond space – as CEO Alexander Lacik articulated in a Bloomberg interview in June: “there have been a lot of small players putting their fingers into the (lab-diamond) pot, but no one with muscle…we (will be) applying the marketing muscle.”

However, Lacik has also stressed that the company’s lab-diamond strategy is a means to “democratise” diamonds, making them “affordable” to a larger population. The Pandora Brilliance line includes pendants, earrings, bracelets and rings – although the rings are not directly being marketed as engagement rings. Accordingly, it appears that Pandora’s marketing approach to lab-diamonds is more “fashion-jewellery” oriented – positioning the product primarily to cater to a new consumer base rather than the existing diamond-buying demographic.

Swarovski, another iconic global fashion jewellery-brand, debuted a collection of fancy-coloured lab-diamonds in early-2020 after having tested various lab-diamond strategies in the preceding years. The line, which is available in 16 vibrant proprietary colours including “Androgyny Flamingo,” “Cubist Sky” and “Heavy Metal Cherry,” does not appear to be positioned as a bridal product either.

That said, mid-market US department store majors, Macy’s and JCPenney, began selling lab-diamonds in 2018 which includes engagement ring offerings. Neither company has provided public feedback on the success of the product so far.

Signet Jewelers, the largest jeweller in the US, and parent of Kay Jewelers, Zales and James Allen, began selling a limited amount of lab-diamonds with bridal options in 2019. However, Signet is seemingly yet to aggressively market the product or provide public feedback on the appetite of the offering. For example, as of October 2021, the Zales’ website still prominently displays natural diamonds on the landing page, with no mention of lab-diamonds.

Notably, all of the above companies currently selling lab-diamonds have historically sold other man-made gems or diamond simulants, e.g. lab-created ruby, emerald, sapphire, moissanite or crystal. On the other hand, notable fine and high-jewellers that historically have not carried lab-created stones (of any sort) do not currently sell lab-diamonds.

Tiffany & Co., the largest jeweller in the world, as well as iconic high-jewellers such as Cartier and Bulgari, do not include lab-diamonds in their merchandise assortment. Nor does Chow Tai Fook, Luk Fook or Chow Sang Sang, the largest jewellers in Greater China. In a direct correspondence with Luk Fook earlier this year, an executive said they do not sell lab-diamonds as they see it for “another kind of customer.”

Privately-held Blue Nile, which is speculated to be the largest online retailer of diamonds globally, began offering De Beers’ Lightbox lab-diamonds late last year. The line is exclusively sold as non-bridal jewellery and is priced at $800-per-carat (up to 2-carat solitaire in size). On a JCK Jewelry District Podcast in September, the CEO of Blue Nile Sean Kell noted that the company’s average engagement ring selling price is about $10,000, noting that the company identifies as a “fine-jeweller.”

Blue Nile competitor, Brilliant Earth, which went public in the US in recent weeks at a valuation exceeding $1 billion, is speculated to be the largest seller of lab-diamonds globally. While the company has been selling lab-diamonds since 2012 it has yet to provide any quantitative sales metrics on the category – however, the company’s average sale is over $3,100, which includes natural diamonds.

—

Paul Zimnisky, CFA is an independent diamond industry analyst and consultant based in the New York metro area. For regular in-depth analysis of the diamond industry, please consider subscribing to his State of the Diamond Market, a leading monthly industry report; an index of previous issues can be found here. Also, listen to the Paul Zimnisky Diamond Analytics Podcast on iTunes or Spotify for wide-ranging and interesting discussions with prominent guests from around the industry. Paul is a graduate of the University of Maryland’s Robert H. Smith School of Business with a B.S. in finance and he is a CFA charterholder. He can be reached at paul@paulzimnisky.com and followed on Twitter @paulzimnisky.