Diamond prices declined in many categories during September, Rapaport informed. The US tariffs and the sale of De Beers perpetuated uncertainty in the market.

Prices declined sharply for round polished goods under 1 carat and were mixed for larger sizes, reflecting a split that has been evident for several months. Long fancy shapes were hot, particularly in 2 carats and up.

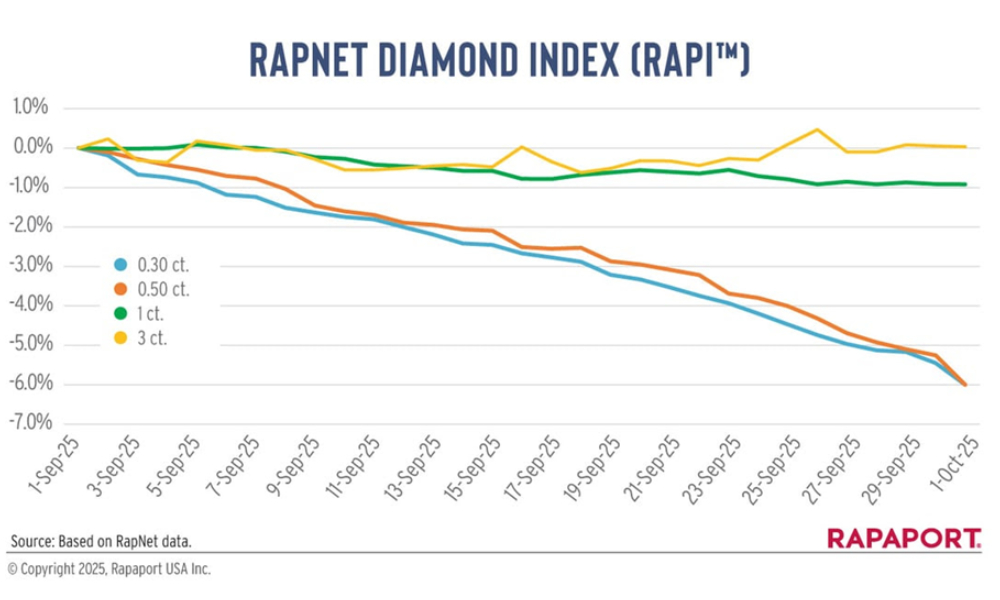

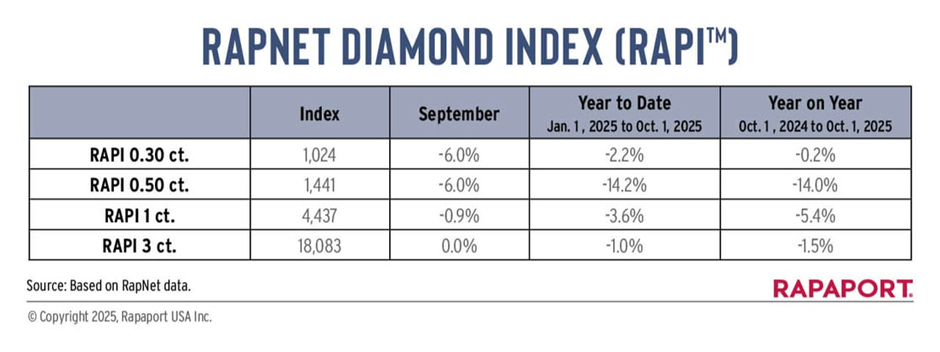

The RapNet Diamond Index (RAPI™) for 1-carat goods — which tracks round, D to H, IF to VS2 diamonds — fell 0.9% in September. Both the 0.30- and the 0.50-carat indices fell 6%. RAPI for 3 carats was flat.

SI-clarity diamonds saw a more negative 1-carat trend than the RAPI qualities did. Prices of round, D to H, SI diamonds in that size dropped 2% in September, according to RapNet data. Prices fell 3.8% for 0.30-carat goods in those categories, and 3.9% for 0.50 carats.

Trading at Hong Kong’s Jewellery & Gem World show mirrored the bifurcation between larger and smaller diamonds: There was mostly demand for the former, especially long fancies.

Independent US jewellers enjoyed steady retail business ahead of the holiday season. However, the import duties restricted overseas suppliers’ sales to the important American retail market.

The European Union obtained a zero-tariff deal for all diamonds polished in the bloc. Botswana is negotiating a similar arrangement. The tariff causing the most concern is the 50% rate on Indian goods. On September 5, the White House added diamonds to a list of possible exemptions for countries that reached trade agreements with the US.

Indian manufacturers have reduced polished production amid weak demand. The country’s rough imports fell to $768.7 million in August from $1.15 billion in July, though the figure was 14% higher than in August 2024.

Anglo American’s sale of De Beers was still in progress at press time. The Botswana government expressed interest in a majority stake, while Angola bid for a minority holding. De Beers extended its sightholder contract through June 2026 amid the uncertainty.