Diamond prices fell in many categories in August as the US tariffs impacted demand for Indian goods. Prices of rounds weakened, though fancies were stable. Deep uncertainty dampened sentiment. US retail and wholesale were steady.

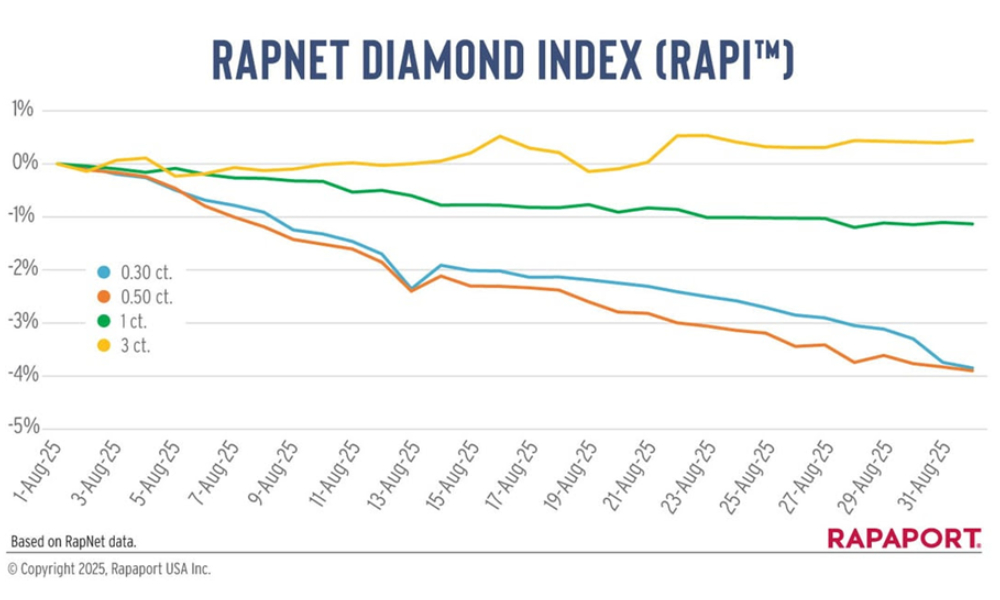

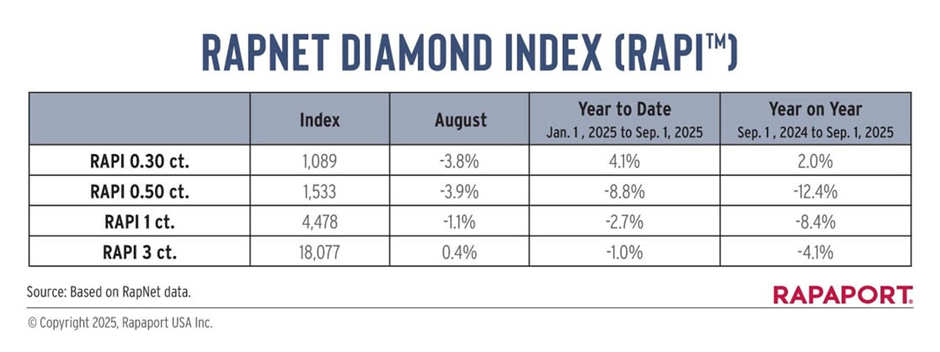

The RapNet Diamond Index (RAPI™) for 1-carat goods — reflecting round, D to H, IF to VS2 diamonds — fell 1.1% in August. The index for 0.30- and 0.50-carat stones declined 3.8% and 3.9% respectively. Larger stones continued to outperform smaller items, with the 3-carat RAPI increasing 0.4%.

US President Donald Trump implemented 25% duties on Indian goods from 1 August and 50% from 27 August. Goods already in America became more desirable than those overseas. The gap in asking prices between US- and India-located inventory on RapNet grew to around 16% in 1-carat commercial goods, from the usual 10% to 12%. The differential still does not reflect the entire tariff.

The levies have shaken up supply chains that developed over many years. Companies have sought low-duty routes and loopholes and relocated inventory to the US. The uncertainty has made it hard to plan and invest in long-term solutions.

On 29 August, the US Court of Appeals for the Federal Circuit declared most of the tariffs illegal. The duties remain in place until 14 October. A Supreme Court battle is likely.

Rough demand weakened as manufacturers reduced production. De Beers customers refused large quantities of goods at its August sight, since the miner’s prices were higher than the open market’s. Bulk sales have flooded the market with low-value rough.

US retail was in decent shape ahead of the holiday season, with solid demand for 2-carat and larger rounds and elongated fancies. Independent jewellers sought merchandise on memo. Major retailers continued shifting to synthetics in fashion jewellery and took a cautious approach to holiday purchases.

Indian retail gained importance in light of the tariffs and China’s ongoing downturn. Trading was strong at Mumbai’s India International Jewellery Show (IIJS).