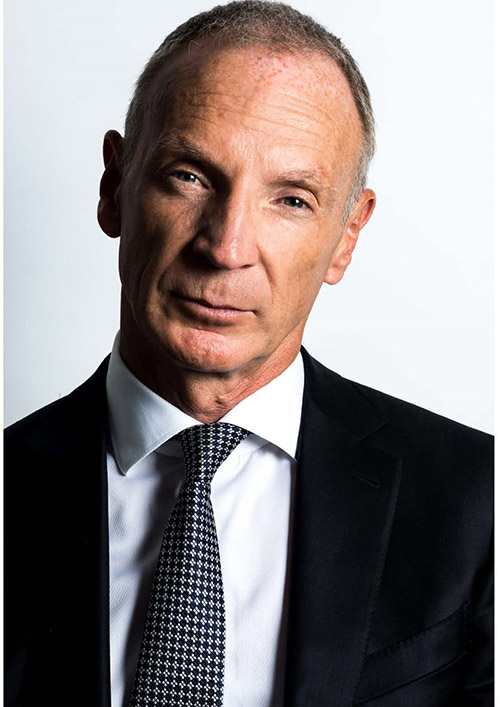

David Tait, Global CEO, World Gold Council, reflects on the progress achieved in 2021, deliberates on the potential future threat posed by regulated cryptocurrencies, and outlines his vision for gold over the next decade, in an exclusive year-end round-up with Solitaire.

What is the WGC’s global roadmap over the next 10 years?

We have a 10-year programme called Gold 24/7 that’s seeking to solve accessibility to gold. It will make gold accessible to literally anyone, all the time, in any form. The second thing it’s hoping to do is solve gold supply integrity – by that I mean the provenance and chain of custody of gold from the mine site right the way through to the ring on your finger. And the last thing it’s seeking to do is create completely fungible markets. Fungible is a strange word, but basically meaning that gold produced in China or India can be sold and traded and used by markets in the United States, UK, Australia, etc. And in doing so, if we manage to join these markets up, I believe we’ll virtually create a new asset class, almost akin to gold’s Big Bang; and gold will be used for financing, collateralisation, and many other uses, which I believe we’ve not even thought of yet. So that’s the big 10-year plan for the overall gold market. That’s our big objective.

How much industry support has WGC received worldwide (and from India) for its Retail Gold Investment Principles (RGIPs)?

The short answer is surprisingly, high amount. I have to say the whole notion was born in India when I first visited the country. India has taken the lead in this respect. Using your example, to be honest, we’ve extended that across Germany, it’s going into the UK, the Italian jewellery market, and most recently, the US. We’re bringing together all the industry associations in the United States, which is very fragmented, and as far as Mexico. So, the short answer is the industry seems to be crying out for some form of coordination, some way of raising trust, transparency, and participation. So, it seems to me that it’s manna from heaven to this industry.

What is the outlook for gold consumption going into 2022?

Gold consumption is well placed to continue higher. Covid has kept a suppressing hand on the economies of the world, but we’ve all been surprised by how quickly they have bounced back, and how much latent demand there is in the system waiting to be used. Second to that, I think the geo-economic and geopolitical landscapes support gold enormously. You’ve got inflation; it looks like the UK has just produced record high numbers. Now will the authorities respond appropriately and in line with those inflation expectations? I think there’s a very good chance they’ll either lag behind or do too much. Both those scenarios are particularly good for gold. And then geopolitically? Well, you only have to look around the world to see all these areas of tension, which I think will support gold into 2022. So I’m positive.

What are the WGC’s biggest challenges in expanding the gold market in India?

We need to be able to impress upon the authorities that regulation and the lowering of taxes will be beneficial to the overall market. I think the introduction of the domestic spot exchange, and SEBI, whose effort to regulate the market we applaud enormously, will do great things towards improving the trust and transparency of participation that is so needed. So I applaud these efforts, and I would like to see more. From a purely cultural perspective, I think expanding gold attraction as both an investment product and as a modern form of expression, call it jewellery … all things are going to work to expand the market in India, and we’ve been doing a lot in that regard with our millennial campaign to get people in tune with a modern form of gold. And secondarily, as I’ve tried to explain, trying to work with the authorities to get gold more regulated, do away with nefarious practice as best we possibly can, and give people the confidence at all levels of society in India, that gold is not only a beautiful piece of jewellery, but it also sustains and protects your wealth, hedges against inflation, and is a worthwhile investment product as well. So the prospects are great. We just need to work harder to get in front of more people and explain what we call the case for gold.

How is the promotion of “digital gold” in India going to affect the physical gold market?

We only support digital gold when it is fully gold-backed. And the gold receipts idea promoted by SEBI is a good one. I think its intentions are sound in trying to squeeze out any forms of nefarious schemes that are in the market, which only do the gold market damage. But I do believe that if a gold receipt programme is accepted, as long as it is fully physically backed, I don’t think it’s going to affect gold demand at all. In fact, quite contrary, I think it should encourage demand, because there’s less risk, as it’s on exchanges, regulated authorities, there is a sense of security you get when you know, you’re buying investment gold and you’re absolutely certain where it has come from the fact that it is vaulted correctly, and you can account for it. That is my goal: to remove the (doubt) from people’s minds, such that more people invest and hold gold over time. What I don’t like to see is pop-up small businesses that can’t prove the gold is there, and many, many times rip people off. The time has come to put an end to that. I want people to be secure and confident when they buy gold that it is what it is, and it is where it is.

Do you envision “sustainably mined” or “green” gold becoming a niche category that will command a premium at the retail level?

Logically you could see a situation where that could happen. But I think if you take into account things like our Responsible Gold Mining Principles, across our participating WGC member miners, that standard is much higher, frankly. And I think all across our industry, that the standard of gold produced by the World Gold Council’s member companies is high enough such that there shouldn’t be really a distinction between gold across the world. I’m hoping that the standards are so high that we don’t form a bifurcated market. I expect all the miners to adopt these policies so fast that it doesn’t bifurcate.

Today what are the main investment avenues competing with gold?

There’s lots of discussion about Bitcoin and whether it is a competitor to gold. I think currently Bitcoin and other cryptocurrencies are great speculative tools, but are they a competitor to gold at the moment? I don’t really believe so. But I also don’t think crypto is going away at all, and I’ve got nothing against it. I do think at some point, when the regulators across the globe regulate Bitcoin enormously, it will become a systemic threat at some point. When they regulate that asset class, then crypto could become a competitive threat to gold. Because many people who buy cryptocurrencies do so because it’s a currency debasement hedge. So is gold. But gold has far more broad qualities than crypto. At that point when it becomes regulated and becomes more of an investment, as I expect it will, I believe it’ll take some people from gold perhaps. The other way of looking at this, if you don’t mind me saying, is if you have cryptocurrencies as part of a portfolio, logically, you must have gold if you didn’t have it before, as a hedge. So you can see there are two sides of the same gold coin, and it could add as an enhancement to demand more than anything else.

This year the WGC launched ‘You are Gold’, its first consumer-centric campaign in India, after several years. Are we likely to see more such direct consumer outreach initiatives by WGC in 2022 as well?

Absolutely! I think there’s a very good case for doing this. I desperately want to make gold relevant as an investment asset. That is my global plan, to make people aware of the benefits it brings to your portfolio. That’s clearly an untapped resource, in India and elsewhere. But from a retail jewellery perspective — we want to make gold relevant to a whole new generation. We want people to understand that responsibly sourced gold is a fantastic thing, and something that people should own for hundreds of reasons. Going into the future, we aim to be doing far more of the outreach that we have done this year. I’ve been very pleased with what we’ve managed to achieve, and I think it’s getting great traction.

Any other message for India’s gem and jewellery exporters?

Yes, I’m hugely pleased and proud of the Retail Gold Investment Principles and guidance. According to our research and numbers, 50% of people don’t trust gold and 60% don’t really understand it too much. The more people adopt the principles and understand the guidance, the more people will come to their market. And essentially, if they can only think of it as growing the pie, the more people will participate, and the pie will grow. And I think that’s the most important thing people need to remember. Trust is everything. Participation is everything.