Will the greatest polished diamond price hike in over 10 years be followed by a cyclical slowdown starting in September? Diamond analyst Edahn Golan shares his insights.

Although polished diamond prices did not rise in July as much as in June, they remain hot. Strong consumer demand in the US and China keep fanning the fire that is heating up prices, providing financial relief to thirsty manufacturers.

Against this backdrop, the mining companies are doing their upmost to meet demand for rough diamonds, despite limited availability.

Price Drivers

This contrast between demand for rough diamonds by manufacturers and limited availability has led to rising rough diamond prices and a scramble for more rough – especially by miners.

However, the resulting shortages are somewhat artificial. Consumers embarking on vacation are less diamond shopping minded, polished diamond inventories at retail are high and won’t rise much more, and the reduced availability in financing is curbing (but not killing) exuberant and speculative rough buying.

The situation above may have a cooling effect on polished diamond prices in August. The one new element pushing up wholesale polished diamond prices is demand ahead of the Las Vegas trade fairs scheduled in late August.

July Price Climb

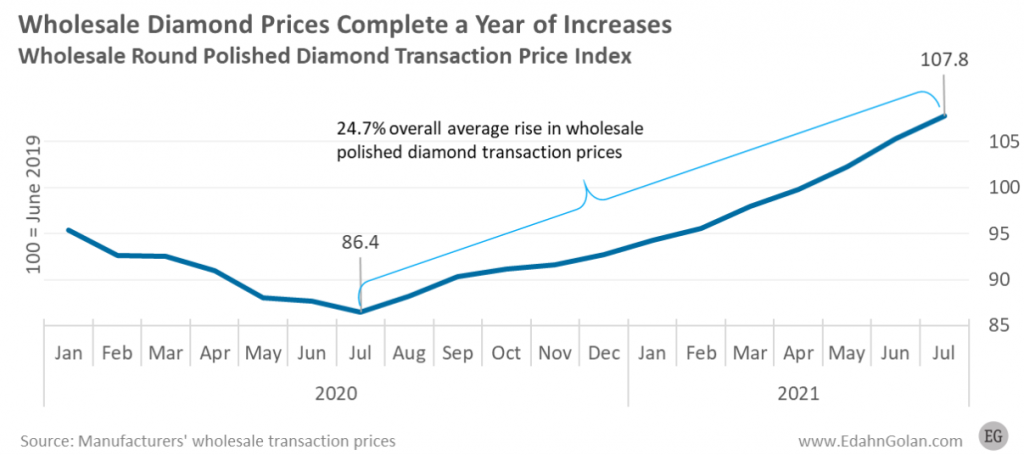

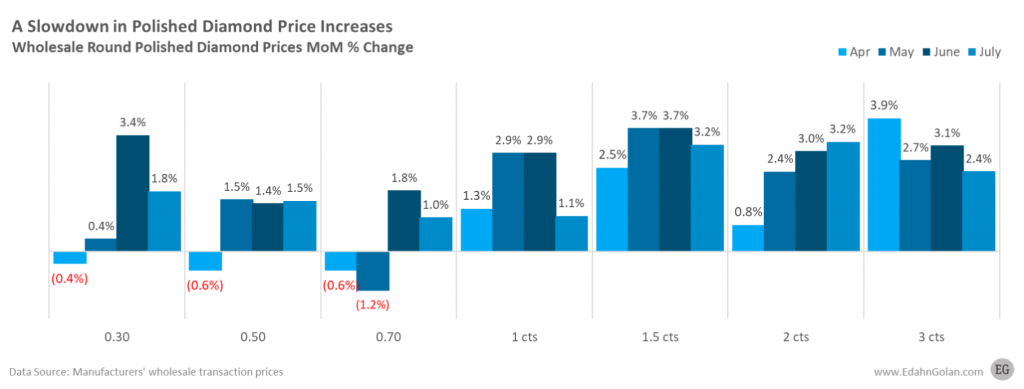

Month over month, polished diamond prices have increased 2.4% on average, reflecting high midstream expectations. This completes 12 months of continued price increases. During this year, prices rose overall 24.7% – the longest and most impressive price increase stretch in more than a decade.

But while wholesale polished diamond prices continue to rise, the pace at which they are rising has slowed down in most size ranges. This is especially true for one-third and one-carat goods.

Conclusion: Be Vigilant

The last major price hike stretch ended in August 2011 in a four-year tumble followed by six years of slowly decreasing prices.

At the time, the market was flooded with money, and retailers in China and India were on an expansion track that required inventory. That is, until they didn’t anymore.

At that point, prices were too high for the American market, leaving the midstream with a drop in demand in three of its four main consumer markets.

This time around, the forces driving price hikes are different. Once we reach September, a cyclical slowdown that does not end before December is expected.

Moreover, demand for lab-grown continues to slowly rise, putting additional pressure on consumer demand for natural diamonds.

—

Edahn Golan is a veteran of the diamond industry, researching and writing about it since 2001. He specialises in a wide range of topics relating to this unique industry, including the way it operates, wholesale and retail polished diamond prices, the rough diamond sector of the diamond pipeline and investment in diamonds. Edahn has written extensively about these subjects and many others, including the Kimberley Process (KP), financing issues, ethics and changes in the way the diamond industry has operated over the years. Prior to founding Edahn Golan Diamond Research & Data, Edahn joined the IDEX Online Group to form the news and research department of its newly launched website. Over the years, Edahn has advised leading diamond firms, industry bodies, investment companies and governmental agencies, writing research papers on topics ranging from provenance analysis of fancy color diamonds and the diamond’s contribution to local economies to the viability of investment in diamonds.

Follow him on Twitter @edahn.