The beginning of every year brings about a flurry of planning activities as companies and individuals set their targets for the year. While we do so, it is wise to review what happened in the previous year, as we begin to make plans for the future.

2022 was a tumultuous year for the world economy in general. The highs of the stimulus and cheap money-driven growth of 2021 lead to the surge in inflation and forced central banks to tighten money supplies as well as increase interest rates. The world is waking up to some of the highest interest rates in over 15 years, after the great financial crisis.

Apart from this trend, the world also entered a new and dangerous phase, with the first major war in Europe in 75 years, and a new era of sanctions upending oil and gas prices across the world. While the rest of the world dusted off Covid restrictions and got back to work, China decided to go in a different direction, with citywide lockdowns, only to do a 180-degree turn in December, when forced by public resentment. The resultant surge in Covid cases will be felt throughout the first quarter of 2023.

From a diamond midstream perspective, 2022 had a spectacular, and almost unreal start, before the euphoria came quickly down to earth by March. This was followed by an uncertain period, as the war in Ukraine upended diamond supplies, before settling toward the middle of the year. In the second half of the year, US diamond jewellery sales, which had plateaued, started to show signs of dropping, while those in China too slowed significantly due to the impact of lockdowns.

US and China are the main jewellery markets and as a result, the industry will end the year on a weak footing and the net polished diamond exports from India are expected to be down by about 7-8% this calendar year. This weakness is expected carry into 2023 as well!

Looking ahead into 2023

When projecting the expectations for the rough diamond, polished diamond and jewellery market, it is again important to understand the expectations for retail sales in the major markets.

In the US, 2021 was driven by the record Covid stimulus, of over USD 2.7 trillion, or over 10% of the GDP in just 2021, leading to a flare up in inflation. To combat this, the US Fed started raising interest rates from March 2022. While initially they were slow and thought to be behind the inflation curve, they have now raised rates by 4.25% in this year, a record by most standards. These interest rates hikes are leading economists to predict a recession in 2023, although there is no agreement on whether this would be a mild or a severe one.

This inflation is demand-led, driven by the bucket loads of free money doled out by the US government. The latest US Fed statements, low unemployment rate, and healthy consumer balance sheets seems to suggest that the world could possibly escape with a mild recession.

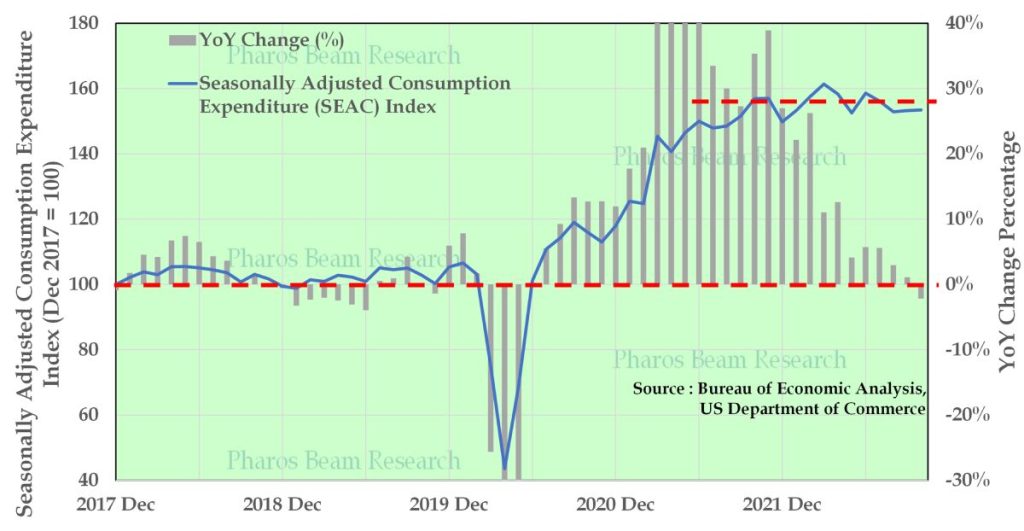

From an industry perspective, I have highlighted in the past that US jewellery sales (based on the numbers published by the Bureau of Economic Analysis) had effectively started plateauing from the second half of 2021. Simply looking at the year-on-year numbers might give a slightly distorted perspective, wherein the impact of the surge continues to be seen after nearly a year. In any case, even a baseline forecast will have to factor in a drop of 8-10% in the US natural diamond retail sales for 2023.

Unsteady China

China, the second largest market for diamond jewellery, too does not inspire confidence going into 2023. It has been grappling multiple self-inflicted challenges including the collapse of the real estate sector and the determination to power ahead with a Zero-Covid policy, apart from other systemic challenges like supply chain diversification by large companies. Two of these decisions have been reversed in December.

The current Covid wave, thought to have started even before the policy reversal, is likely to continue through the first quarter of 2023, with a large number of deaths being forecast. This, in turn, will affect retail sentiment and the market. It will still take a herculean task to stabilise the Chinese economy, with leading agencies trimming their growth forecast.

While lower economic growth would dampen diamond jewellery demand in China, the reduced attraction of the real estate market might prompt greater interest in asset buying demand for gold and diamonds. Overall, the jewellery market would be expected to be weak in the first half, and some stabilisation and positive comparative numbers in the latter part of the year.

In the other global markets, Europe and Japan are expected to be plagued by inflation and other economic issues, and likely to have a negative year as well. In general, the dollar strength is expected to continue, and markets which are not dollar-denominated will underperform.

In terms of bright spots, India stands out as the market which had a good run in 2022 and is expected to weather the economic storm better than other economies. The diamond jewellery market will also follow, and will be one of the markets expected to have the highest growth. Additionally, the Middle East market, driven by buoyant oil prices, is expected to continue to do well. Luxury brands have had a stellar 2022 and they too will continue their run.

Tough ride ahead

Retail expectations show that retail demand for diamonds would be about 4.5% lower in 2022, and will fall at least a further 5% in 2023.

The US market accounts for 60% of the diamond market and slowing sales, coupled with the bull-whip effect on the pipeline, meant that the effects on the polished and rough sections of the pipeline were felt from the middle 2022 onwards. In polished terms, the demand was down over 10% in 2022 as compared to 2021 and will further drop by nearly a similar percentage in 2023.

Rough markets have traditionally shown a more delayed response to the retail and polished markets. They will contract by about 6% in 2022 and by a further likely 10% in 2023.

From an overall Indian midstream perspective, companies would have seen profit meeting “normal” expectations over the course of 3 calendar years from 2020 to 2022, with large profits in 2021 and losses in the other years. The nearly 15% weakening of the rupee has also supported profitability.

Company balance sheets in the industry too would have seen an improvement in debt ratios till 2021 with some weakening in 2022. However, the balance sheet ratios would be significantly better at the end of 2022 than that at the end of 2019, with the industry requiring lower bank debt.

Market Cannibalisation by LGD

Lab-Grown Diamonds (LGD) has achieved significant retail store penetration and, in turn, sales in the US over the last 2-3 years. Unfortunately, these sales have been achieved through cannibalisation of the natural diamond jewellery market as retailers offered LGD jewellery as an alternative to natural diamond jewellery. Retailers have pushed larger LGD product to consumers at the same price point for natural jewellery as their margins and profits are much higher in LGD jewellery. The reduction in LGD wholesale prices in 2022 was not fully passed on to the retail consumers, and further padded retailer margins.

To date, the LGD market growth was during a period of secular market growth, and the pain on the natural pipeline had been masked. In 2022 Christmas season and in 2023, we will be facing a shrinking overall jewellery market along with increasing LGD penetration, and the full impact of the cannibalisation will now be felt on the natural pipeline.

How this fight for supremacy will pan out over the next few years, is up for debate. The natural diamond industry has always depended on its ability to retain its value and consider it their strongest suit against LGDs. As the battle for the consumer dollar intensifies at the retail level, prices of LGD jewellery will continue to be under pressure. It will be interesting to see how the consumer reacts to significantly lower prices on LGD products bought by them a few years ago.

While retailers, driven by higher margins, have clearly picked their side, the result of this battle between LGD and natural diamonds could well be determined by actions and decisions taken by individual pawn shops across the US, as they set the buy-back prices for natural and LGD diamonds. In fact, giving free or subsidised diamond testing machines to pawn shops could be a tactic adopted by the Natural Diamond Council, and it might even give them the best return on their investment!!

Pranay Narvekar, Partner at Pharos Beam Consulting LLP, is a leading expert on many of the crucial strategic, financial and structural problems facing the diamond industry pipeline. He has been among the initial supporters of the LGD industry. He has over 20 years of consulting experience and has previously also worked with Rosy Blue. He can be reached at pranay@pharosbeam.com