Diamond analyst Paul Ziminisky examines the supply-demand dynamics pushing diamond prices upwards.

While global rough diamond supply is on track for a forecasted 119 million carats of production this year, according to Paul Zimnisky estimates, which is up slightly over 2020, diamond output continues to be well below the levels seen during most of the last decade. With much stronger consumer demand for diamonds beginning in the second half of 2020 and continuing into 2021, demand is now seen significantly eclipsing new production for the first time in years. Consequently, miners have recently liquidated excess inventories to make up for the shortfall.

Major miner inventories are now estimated to be at the lowest level in years, which was, in part, confirmed by Alrosa on an analyst call in May. Management noted that after destocking in the first part of 2021, the company’s rough diamond inventories are at a “historic low level” and approaching deficit territory.

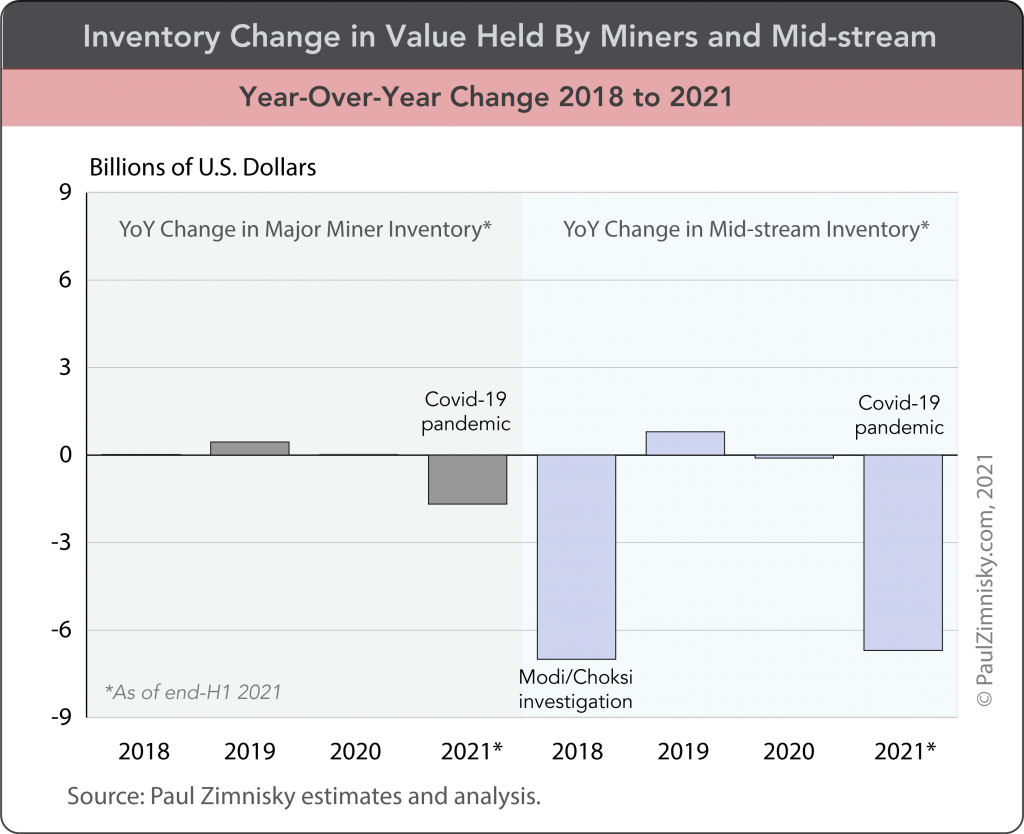

Robust consumer demand and pandemic-related supply-chain disruptions have also pressured stocks held by the midstream segment of the industry. A Paul Zimnisky analysis shows that midstream inventories are currently estimated at about $28 billion, which compares to as much as $35 billion a year ago and over $40 billion in the fiscal year ended March 2018. (see table below)

On the Alrosa call, responding to an analyst’s question about the diamond industry’s current supply-demand dynamic, management bluntly responded “the only reconciliation for supply and demand is price” – and the combination of strong demand and tighter supply has in fact had a positive impact on diamond prices in 2021, which continues through mid-year.

Rough diamond prices are up 14.5% year-to-date as of mid-June according to the Zimnisky Global Rough Diamond Price Index, a consolidated rough diamond price proxy. Subsets of the Index show that all size categories are performing well in 2021, however larger categories are outperforming. Sub-indexes of 5 to 9-carat and 3 to 4-carat categories are up a notable 28% and 21%, respectively, year-to-date.

In June, Mountain Province Diamonds, joint-venture partner in the Gahcho Kué mine in Canada’s Northwest Territories, said it saw prices for its product mix increase 18% on a like-for-like basis in Q2 over Q1. Management also noted that all of an estimated 1.5 million carats inventory held by Dunebridge Worldwide, a strategic partner of the company, was sold in Q2 – highlighting the supply-chain’s current appetite for rough.

Looking forward, demand is likely to be the more volatile variable in the supply-demand equation. On June 10, Signet Jewelers, the largest specialty jewellery conglomerate in the US and UK, raised sales guidance for the fiscal year ending January 2022 by over 8% to $6.6 billion. It is the second time that the company has raised sales guidance in just two months. Signet management attributed the current strong environment in part to “tailwinds from (the US’s economic) stimulus and slower than anticipated return to travel and experience spending.”

However, Signet has also said that it remains cautiously optimistic for the remainder of the year noting, “as the vaccine rollout matures, the company believes there will be a shift of consumer discretionary spending away from the jewellery category toward experience-oriented categories.” Given this expectation and a high-base (comparable), the company is currently guiding same-store-sales to be negative in the second half of the year.

—

Paul Zimnisky, CFA is an independent diamond industry analyst and consultant based in the New York metro area. For regular in-depth analysis of the diamond industry, please consider subscribing to his State of the Diamond Market, a leading monthly industry report; an index of previous issues can be found here. Also, listen to the Paul Zimnisky Diamond Analytics Podcast on iTunes or Spotify for wide-ranging and interesting discussions with prominent guests from around the industry. Paul is a graduate of the University of Maryland’s Robert H. Smith School of Business with a B.S. in finance and he is a CFA charterholder. He can be reached at paul@paulzimnisky.com and followed on Twitter @paulzimnisky.