Demand for gold bars and coins in the US jumped in 2020, mirroring the rush for gold ETFs that took holdings in those products to record highs.

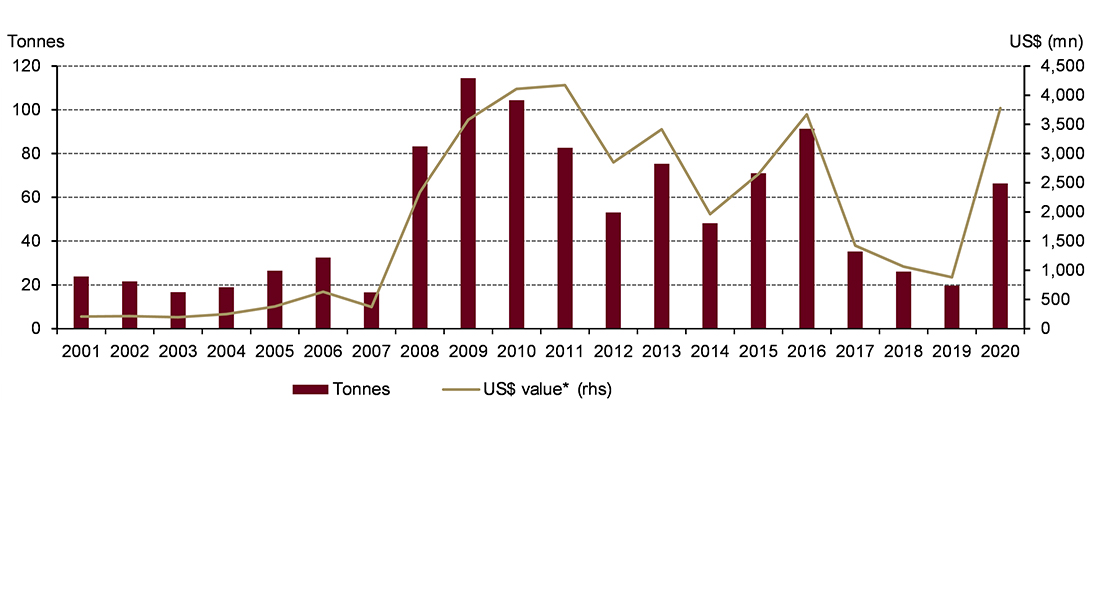

Having languished at a relatively weak 20t in 2019, retail investment more than trebled to 66t in 2020.1 And while that remains some way below the levels seen during the Global Financial Crisis, bar and coin demand measured in value terms rocketed to almost US$3.8bn – the highest since 2011.

US retail investment hit the gas in 2020

Annual US demand for gold bars and coins, volume and value

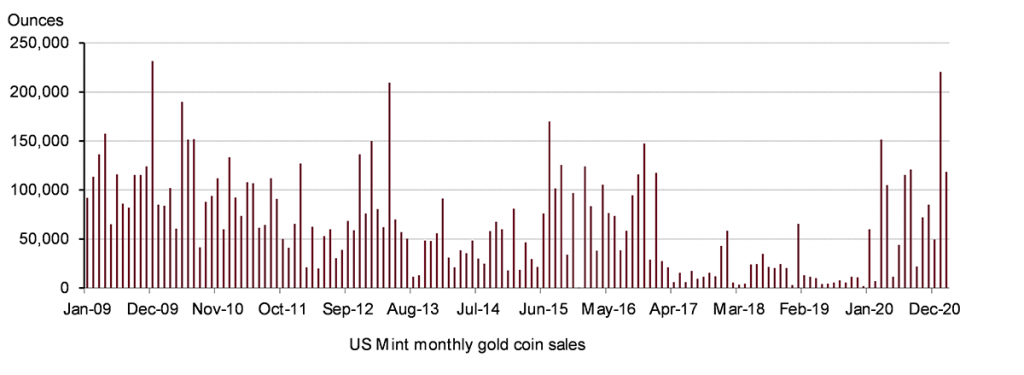

According to recent data from the US Mint, this trend shows no sign of stopping so far in 2021. Sales of gold Eagle bullion coins topped 220,000 ounces in January (~6t). That’s the highest monthly total since December 2009 and the strongest January sales so far this century.2 And the momentum has continued into February, with sales having reached 118,500 ounces just after halfway through the month, also a 22-year high for February sales.

So, what drove this interest in 2020? Broadly speaking, we can point to four key elements:

- The COVID-19 fear-factor

The global coronavirus pandemic was an obvious influence throughout last year. The sharp rise in gold bullion coin sales by the US Mint in March and April are clear evidence of the strong response by US investors to the rapid global spread of the virus at that time. A well-established online infrastructure allowed gold bar and coin to thrive, in contrast to markets such as India, where market lockdowns stifled investment. Nevertheless, a supply chain squeeze restricted the availability of some products (due to the closure of some mints and refineries, and a skeleton international flight schedule) and likely prevented demand in Q2 reaching its true potential.

Gold bullion coin sales have kept up the pace so far this year

US Mint monthly gold bullion coins sales, Total ounces

Source: US Mint

- Pent-up savings

Although the economic impact of the coronavirus is unquestionable – GDT growth contracted by a staggering 31% in Q2, while unemployment spiked to 15% – the impact on aggregate income has been somewhat counter-intuitive.3 Not only were lower paid jobs the worst hit, but stimulus checks and unemployment insurance injected vast sums into US pockets.4 Meanwhile, spending has slumped. Unable to splurge on restaurant meals or holidays, many of these extra dollars have been directed towards a range of financial assets…with gold being a likely beneficiary.

- Interest rate cuts and fear of inflation

Adding to safe-haven flows, investment demand in 2020 was fuelled by rate cuts as the Federal Reserve slashed rates to zero in Q1.5 Faced with the reality of not being compensated for saving cash, gold gained greater appeal, particularly with inflation fears stoked by huge fiscal stimulus, which inflated the US budget deficit to record levels.

- A rising gold price

And adding further momentum to the upsurge in investment was the movement of the gold price during the year. US dollar gold rose by nearly 25% over the course of 2020, reaching record highs in August in the process. This strong performance in and of itself attracted some investors into the market.

This picture for US investment demand in 2020 neatly illustrates the four key drivers of gold demand – risk and uncertainty, opportunity cost, economic expansion (specifically in this case, growth in savings and earnings) and momentum – which form the basis of our Gold Valuation Framework; a model that explains the performance of gold through the fundamental intersection of gold demand supply.

The analysis above shows all four drivers were in evidence in the US market in 2020. And while the price momentum driver may have been less of an influence in recent months, the remaining drivers are clearly playing a lead role: interest rates persist at near-zero for savers while expectations are widespread for continued government spending to expand the budget deficit still further, opportunities for discretionary spending remain limited, with widespread lockdowns still in place to ease the significant burden on healthcare systems; and uncertainty remains rife as to the nature of life under the continued shadow of COVID-19.

Consumer research also substantiates the trend we are seeing in US investment growth. Our large-scale 2019 survey showed that US retail investors see gold as fulfilling two main roles in a portfolio: between one quarter and one third of investors view it as being for wealth protection, while around two thirds see its role as delivering returns.

US investors see gold performing a dual role: protecting wealth and delivering returns

Individual investors’ views of the role that gold plays in portfolios*

Source: Hall &Partners, World Gold Council

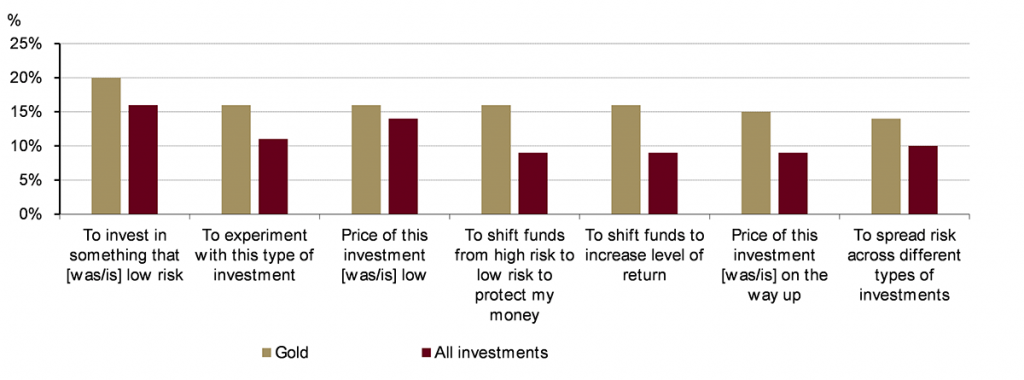

And investors also told us that the trigger for an investment in gold is more likely – compared with other assets – to be triggered by the need to spread/reduce risk or by the price being on an upward trend.

Risk considerations and a rising price are relatively important for US gold investors

Triggers that prompted individual investors to make a specific investment in gold*

Source: World Gold Council

These insights underscore the huge increase in US retail investment demand: gold’s low-risk nature – brought into focus by the huge increase in uncertainty caused by the pandemic – may have triggered investment by those who identify it as offering wealth protection; while its upward price trend in 2020 likely attracted those who view it as a source of returns.

And while the experience of 2020 does not suggest a repeat performance in 2021, we view conditions as being particularly supportive for gold investment during the year ahead.

Footnotes

1 Retail investment refers to investment demand by individuals for gold coins and small gold bars (1kg and below). In our Gold Demand Trends data, it is the sum of physical bar demand, official coin demand and medals/imitation coin demand. For more information, see Gold Demand Trends notes and definitions.

2 Previous high for January sales was in 1999, with total sales of 281,000 ounces Bullion Sales | U.S. Mint

3 tradingeconomics.com/united-states/gdp-growth; tradingeconomics.com/united-states/unemployment-rate

4 www.nytimes.com/2021/01/01/upshot/why-markets-boomed-2020.html

Article republished with permission from the World Gold Council (www.gold.org).