Diamond trading was quiet in late December as wholesalers took vacation between Christmas and New Year, Rapaport said in a release. The industry was cautious due to sluggish US consumer demand and competition from synthetics.

The holiday season for the overall jewellery market was weaker than in 2022 but in line with expectations. US jewellery sales fell 2% year-on-year for the period between 1st November and 24th December, Mastercard SpendingPulse reported. Restaurant revenues rose 7.8%, indicating a shift from products to experiences. Chinese diamond demand remained slow amid an economic slump.

Polished prices rose in most categories as India’s two-month voluntary freeze on rough imports — which ended 15th December — reduced inventories. India’s rough imports for November slid 76% year-on-year to $314 million. Manufacturers were under less pressure to sell, since they needed less cash to buy rough, Rapaport noted. Holiday orders supported prices for 1- to 3-carat, F-I, VS-SI, RapSpec A3+ diamonds.

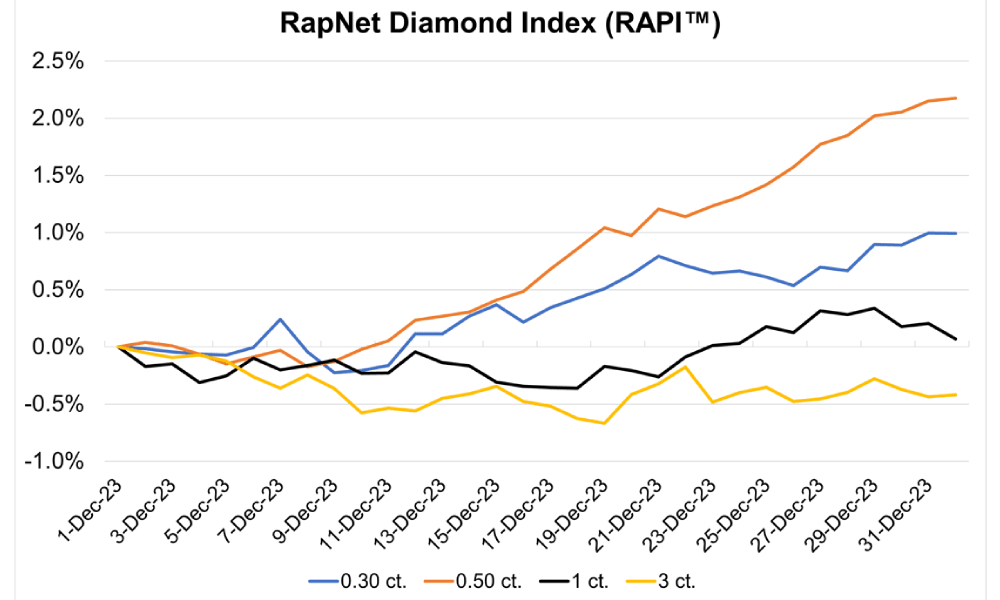

RapNet Diamond Index (RAPI™)

| Index | December | 4Q 2023 | 2023 | |

| RAPI 0.30 ct. | 1,418 | 1.0% | -0.3% | -4.3% |

| RAPI 0.50 ct. | 1,980 | 2.2% | 2.1% | -25.9% |

| RAPI 1 ct. | 5,981 | 0.1% | -1.4% | -20.6% |

| RAPI 3 ct. | 22,021 | -0.4% | -0.7% | -11.3% |

© Copyright 2024 by Rapaport USA Inc.

The RapNet Diamond Index (RAPI™) for 1-carat diamonds rose 0.1% in December. The index for 0.30-carat stones increased 1%, and the 0.50-carat RAPI climbed 2.2%. Prices for fancy shapes were stable or declined.

The 0.50- and 1-carat RAPI categories had their worst full year on record, falling 26% and 21% respectively. However, the trend improved from November onward as US retailers bought for the holidays and Indian factories lowered polished production. The number of diamonds on RapNet fell 8% during 2023, totalling 1.6 million on 1st January, 2024.

Some sightholders expect De Beers to reduce rough prices in January to stimulate sales. This could have an immediate impact on polished prices. To avoid an oversupply, manufacturers must ensure that their purchases match polished demand, Rapaport explained.

January also marks the introduction of broader Group of Seven (G7) restrictions on Russian diamonds. An expanded ban on any polished resulting from Russian rough begins 1st March. The implementation could profoundly affect supply dynamics, it added.